Understanding Taxable Municipal Bonds

Introduction

Taxable municipal bonds are a growing segment of the municipal bond market. Consider using this publication to learn a bit about them before you approach an investment professional and tax advisor to find out more.

Learn:

- The meaning of “taxable” in taxable municipal bonds

- Reasons why taxable municipal bonds are less common than tax-exempt bonds

- Ways to use the free Electronic Municipal Market Access (EMMA®) website to locate and research public taxable municipal bonds

Get started:

- Taxable Municipal Bond 101 for Investors

- The Taxable Municipal Bond Market

- Locating New Taxable Municipal Bonds

- Locating Disclosures for Taxable Municipal Bonds

- Locating Trading Information for Taxable Municipal Bonds

- Appendix: EMMA Resources List

The Municipal Securities Rulemaking Board (MSRB), a regulator in the United States that specializes in municipal bonds, prepared this publication for educational purposes only. The information is not investment, tax, business, legal or other advice. For help, contact:

- Investment professionals with questions about investing

- Tax advisors with questions about the tax implications of investing

- The MSRB with questions about EMMA and MSRB resources. Use the MSRB contact form.

Taxable Municipal Bonds 101 for Investors

Taxable municipal bonds are a category of municipal bonds. Governmental entities issue municipal bonds to raise money for infrastructure and other capital projects. Investors purchase them. In return, investors receive interest payments and the return of the invested principal at maturity or redemption.

Issuers structure municipal bonds to have one of three federal tax statuses: tax-exempt, taxable or subject to alternative minimum tax (AMT). If a bond is tax-exempt, the interest income earned on the bond is not subject to taxation by the U.S. federal government. If a bond is taxable, the interest income is federally taxable. If a bond is subject to AMT, the interest income is subject to federal taxation if the AMT applies to the taxpayer who owns the bond in a taxable account.

Investors shouldn’t take the category names too literally. By way of example, income from “taxable municipal bonds” may be exempt from some taxes depending on the circumstances. Some state and local taxing authorities don’t tax bond income or don’t have an income tax at all. Likewise, realized capital gains from “tax-exempt municipal bonds” can result in federal income taxation.

|

Are My Municipal Bonds Taxable?

|

||

|

Categories |

Subject to Federal Taxation |

Subject to State and Local Taxation |

|

Tax-exempt |

No |

Depends on taxpayer’s location and applicable tax law |

|

Taxable |

Yes |

|

|

Subject to AMT |

Only when the taxpayer must pay AMT |

|

When deciding whether to purchase taxable municipal bonds or tax-exempt municipal bonds, or both, investors should consider all the relevant factors. In particular, they should consider the features and risks of the bonds for sale. Usually, taxable municipal bonds offer a higher yield, or rate of return, than tax-exempt municipal bonds with similar features and risks. The higher yield compensates investors for the income taxes they could save if they instead owned a comparable tax-exempt bond. In addition, they should consider the type of account they’ll use to make the purchase. Investors, who often are in lower tax brackets later in life, can minimize their tax consequences by using a tax-advantaged account such as a 401(k) to purchase a taxable bond. In such accounts, the federal government doesn’t tax the bond income in the year it is received. Instead, it taxes the amount the investor withdraws from the tax-advantaged account in the year the withdrawal occurs.

|

What is the Taxable Equivalent Yield of My Tax-Exempt Municipal Bond? |

||

|

Formula for Taxable Equivalent Yield |

Assumptions |

Example |

|

Tax-exempt yield ________________

(1 – Tax bracket) |

|

3.00%

|

The Taxable Municipal Bond Market

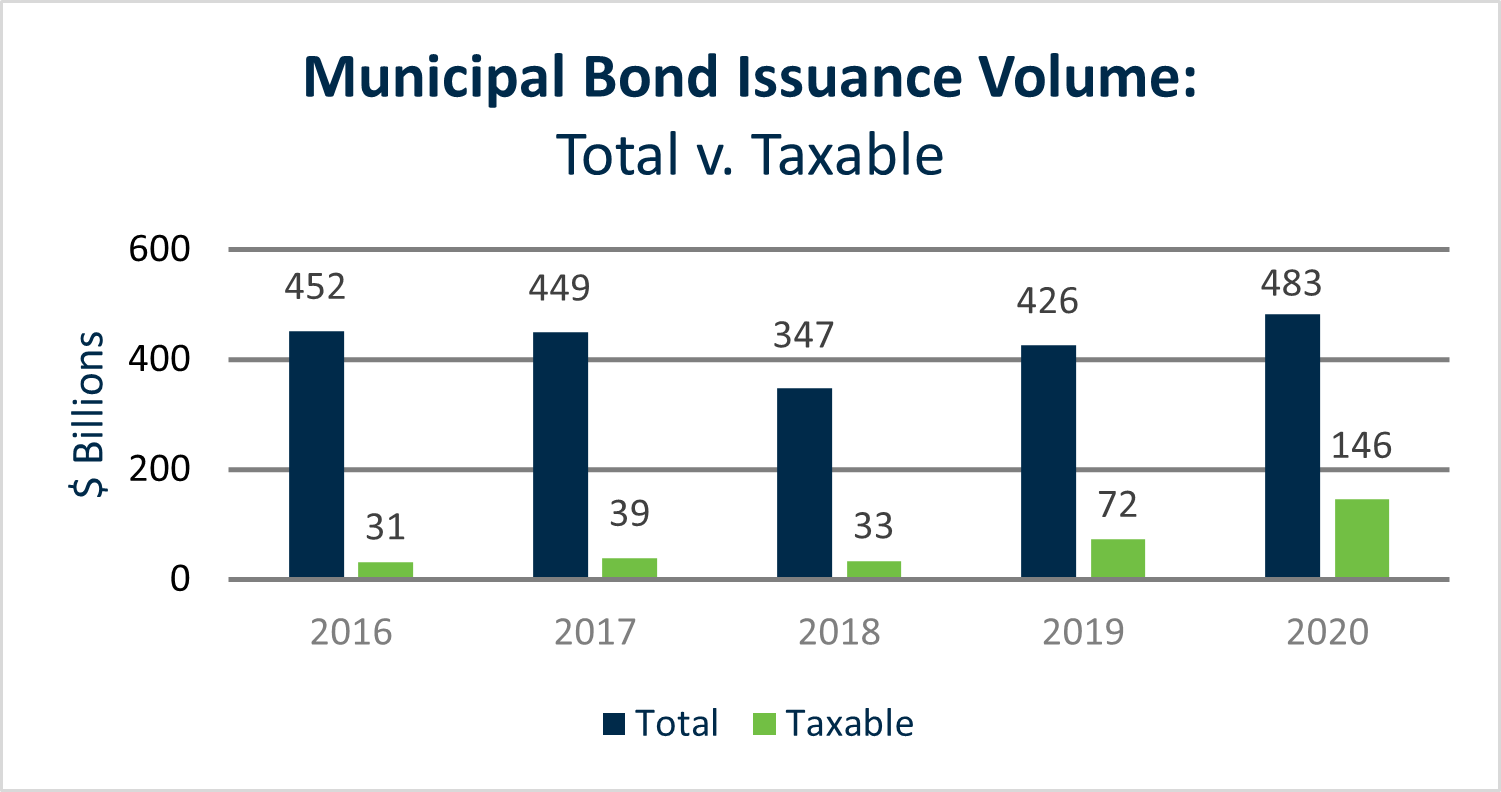

The taxable municipal bond market is a growing yet relatively small segment of the overall market. Between 2016 and 2020, there was approximately $2.157 trillion of municipal bond issuance. During the same period, there was $321 billion of taxable municipal bond issuance, or approximately 15% of the total. Notably, the taxable segment grew from $33 billion in 2018 to $146 billion in 2020. Approximately 30% of new issuances in 2020 were taxable municipal bonds.

Source: Refinitiv

Generally, issuers produce taxable municipal bonds when they legally can’t produce tax-exempt ones. Issuers almost always save money by issuing tax-exempt bonds instead of taxable bonds. The savings arise because the federal government effectively helps the issuer pay investors for the capital they lend to the issuer. The implied payment is in the form of not taxing interest income. Issuers, however, can’t use the tax-exempt status when the underlying capital project lacks a public purpose or use, or otherwise cannot meet the tests under federal tax law. For example, building a public university student center that primarily will house a restaurant run by a private corporation likely wouldn’t qualify because the federal government would say the private corporation, not taxpayers, should pay to construct the restaurant. In addition, issuers can’t issue tax-exempt debt when undertaking certain types of debt refinancing.

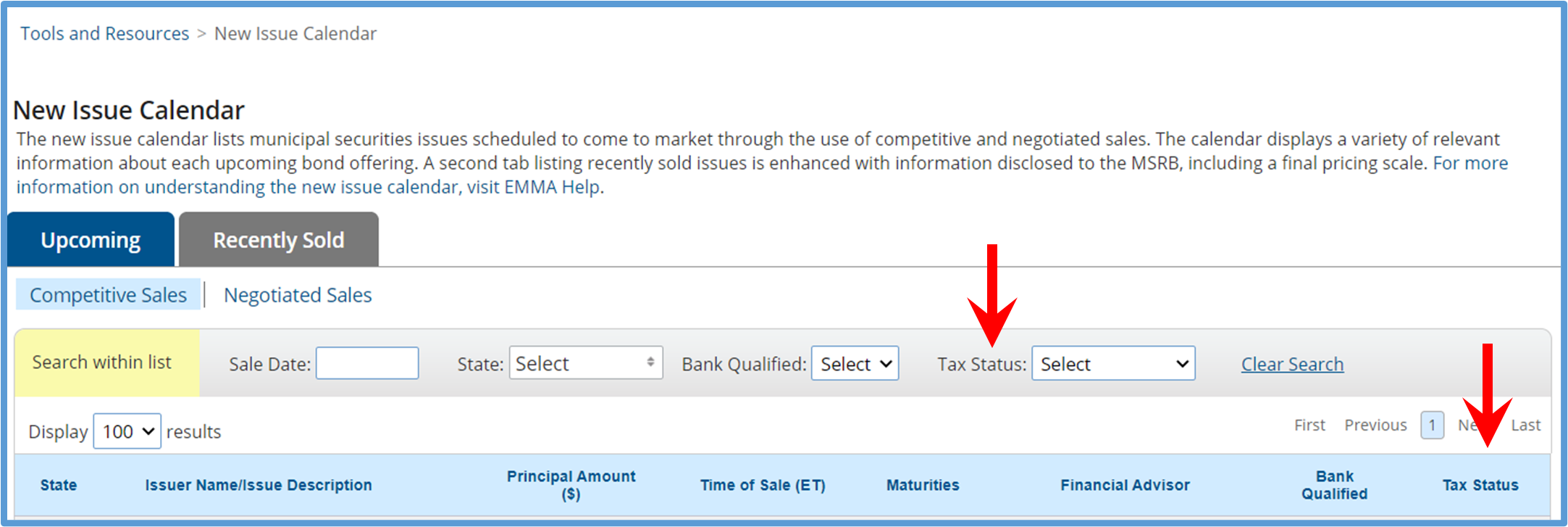

Locating New Taxable Municipal Bonds

The New Issue Calendar on EMMA displays upcoming municipal bond offerings on the Upcoming tab and recently sold issues on the Recently Sold tab. From the Upcoming tab, users can toggle between lists of municipal bonds coming to market through competitive sales or negotiated sales. Users of the New Issue Calendar can use the Tax Status column on the right side of the calendar to differentiate between tax-exempt, taxable or subject to AMT municipal bonds in the results. In addition, use the Tax Status and other search filters to adjust the calendar’s display. Selecting Taxable from the dropdown list will restrict the calendar results to only taxable municipal bonds.

Locating Disclosures for Taxable Municipal Bonds

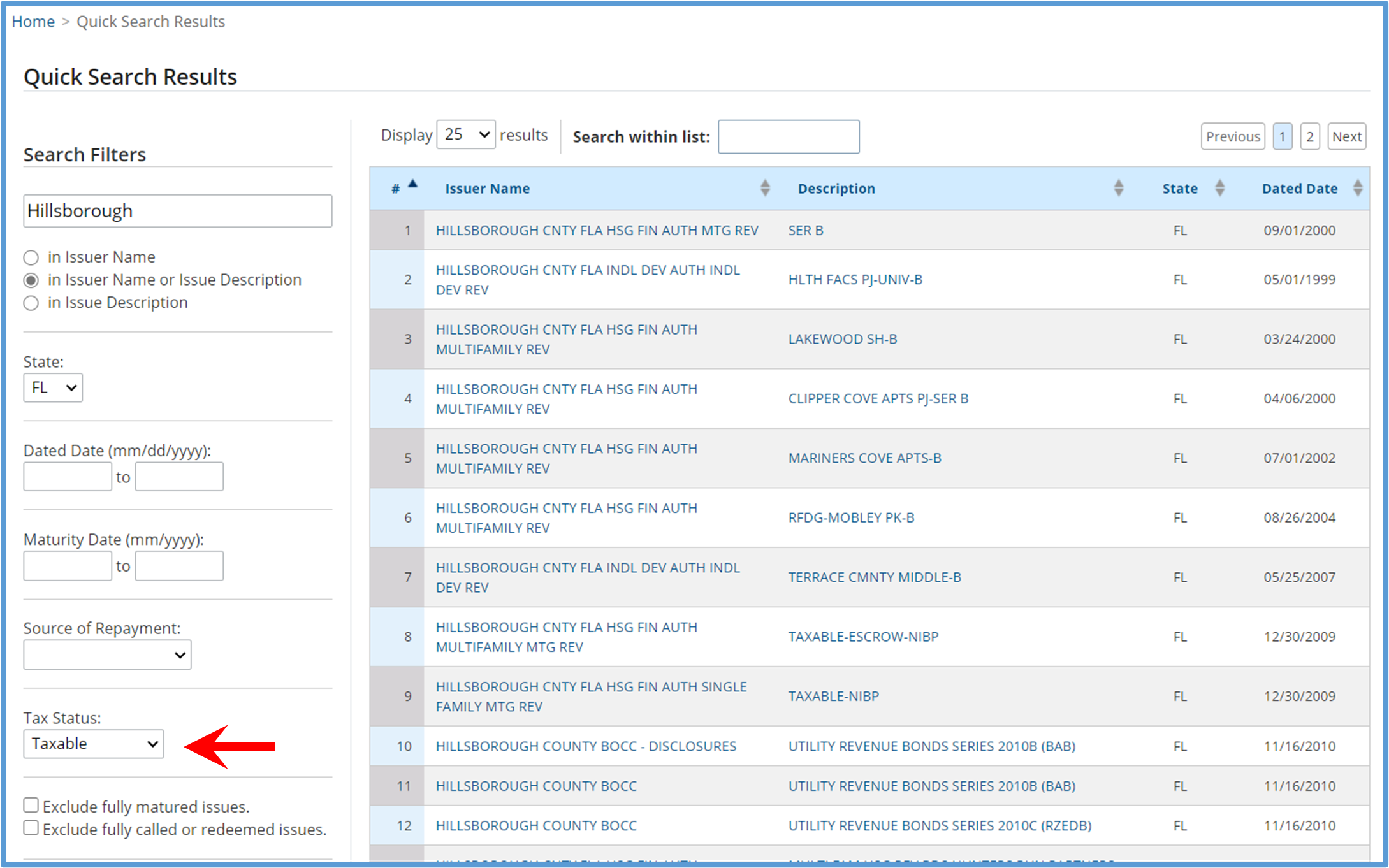

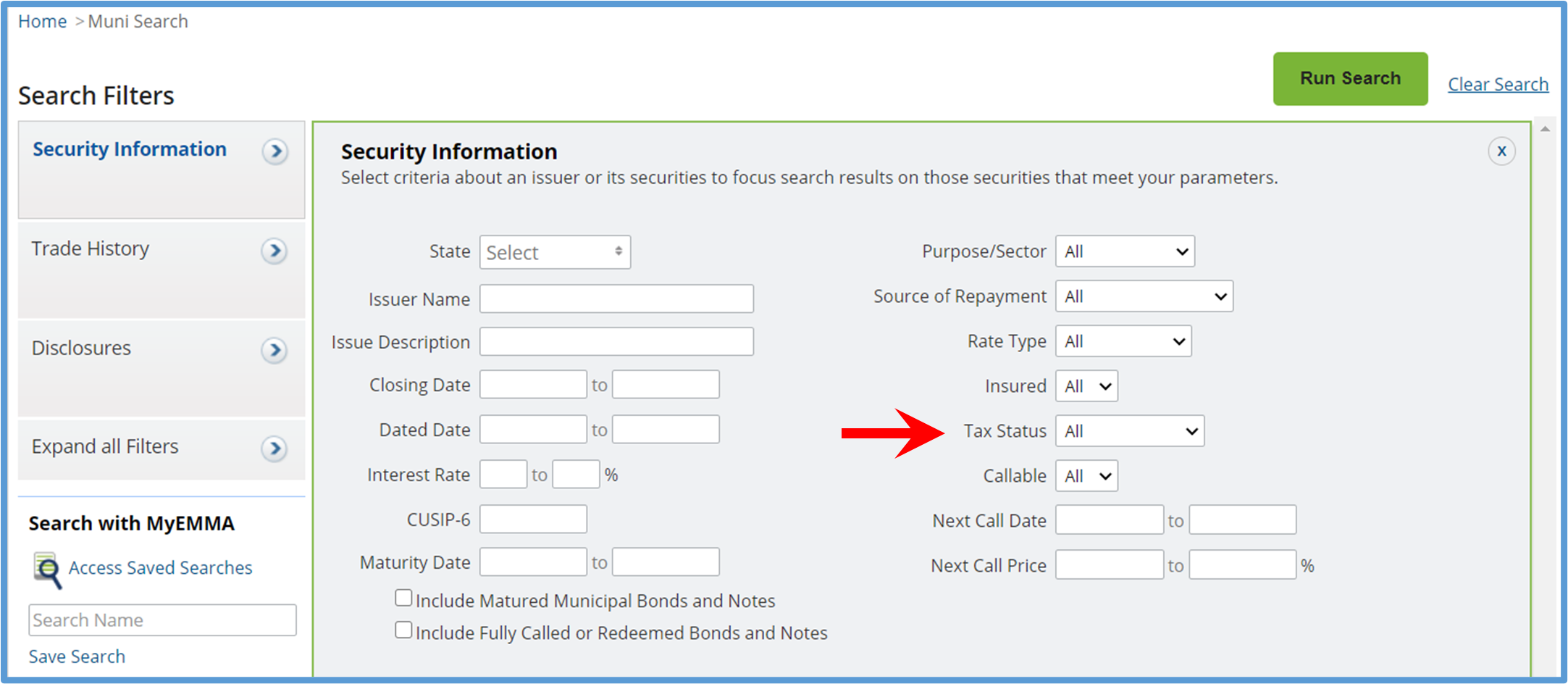

EMMA’s Quick Search and Advanced Search make it easy to locate taxable municipal bonds and important disclosures about them.

- Quick Search is like an Internet search engine. Enter keywords for the issuer’s name or the issue description into the box to generate a dropdown list of the top-10 matched terms. Select “… in Issuer Name or Description” from the dropdown list to be directed to Quick Search Results. Use the Tax Status filter on this page to restrict your results. Alternatively, if you have it, enter the 9-digit CUSIP® for a particular municipal bond to go directly to the disclosure documents on EMMA for it.

- Advanced Search is an enhanced version of Quick Search. Click on the words Advanced Search underneath the Quick Search box to make the Search Filters page appear. On this page, select or type your preferred search parameters, including Tax Status.

Quick Search

Quick Search Results

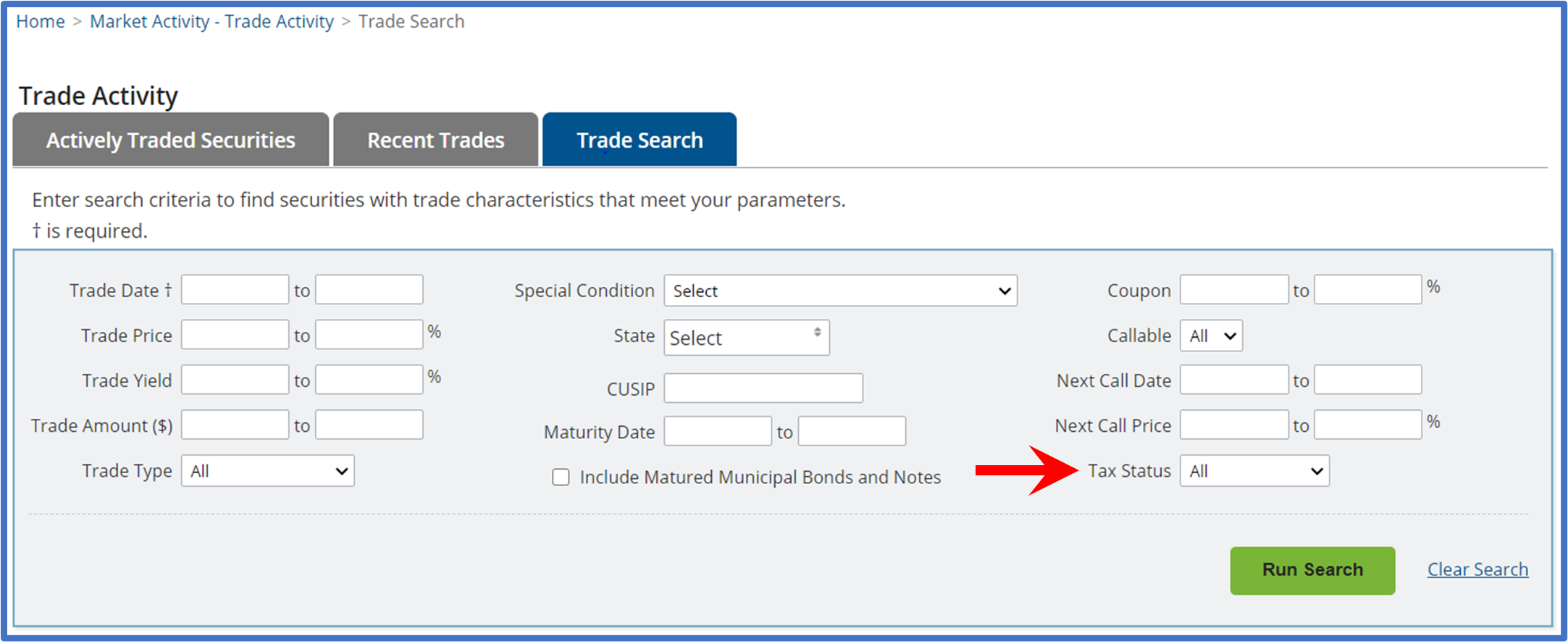

Locating Trading Information for Taxable Municipal Bonds

EMMA has tools that make it easy to locate and analyze trading information about municipal bonds.

- The Trade Search form allows you to locate municipal bonds that have traded between two dates.

- The Most Active Securities and Issuers Search generates a list of the 20 most active municipal bonds and issuers.

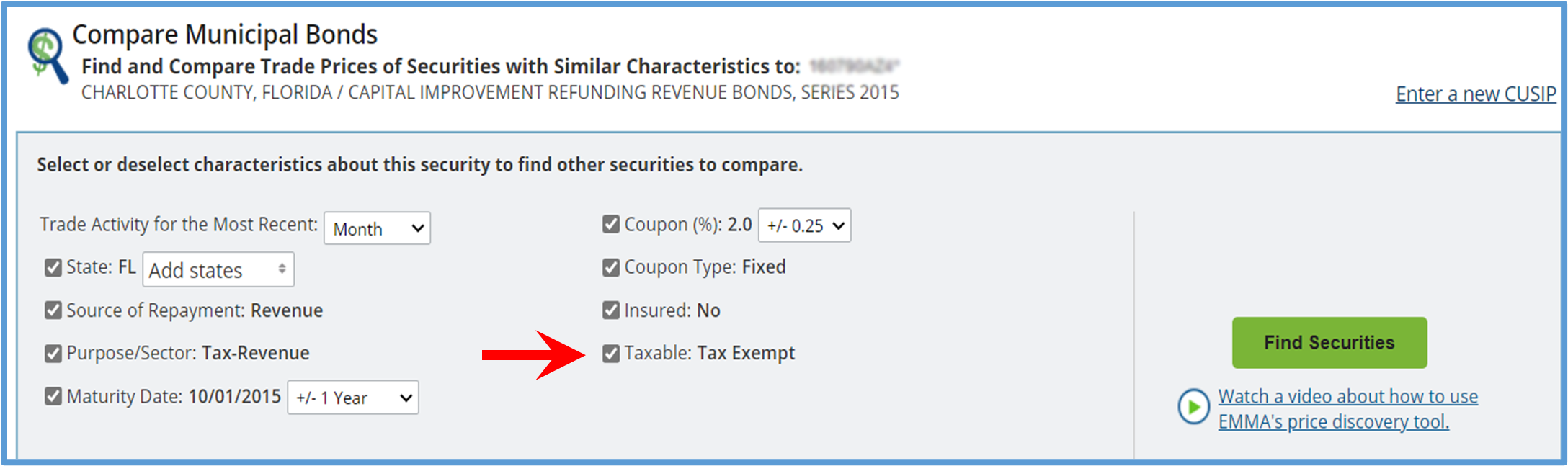

- The Compare Municipal Bonds form allows you to find and compare trade prices of municipal bonds with similar characteristics.

As shown below, each tool has a Tax Status filter that allows you to restrict results by tax status (tax-exempt, taxable and subject to AMT).

Trade Search

Most Active Securities and Issuers Search

Compare Municipal Bonds

Advanced Search – Search Filters