Contact: Leah Szarek, Chief External Relations Officer

202-838-1300

lszarek@msrb.org

MSRB ANNOUNCES MEMBERS OF 2023 COMPLIANCE ADVISORY GROUP

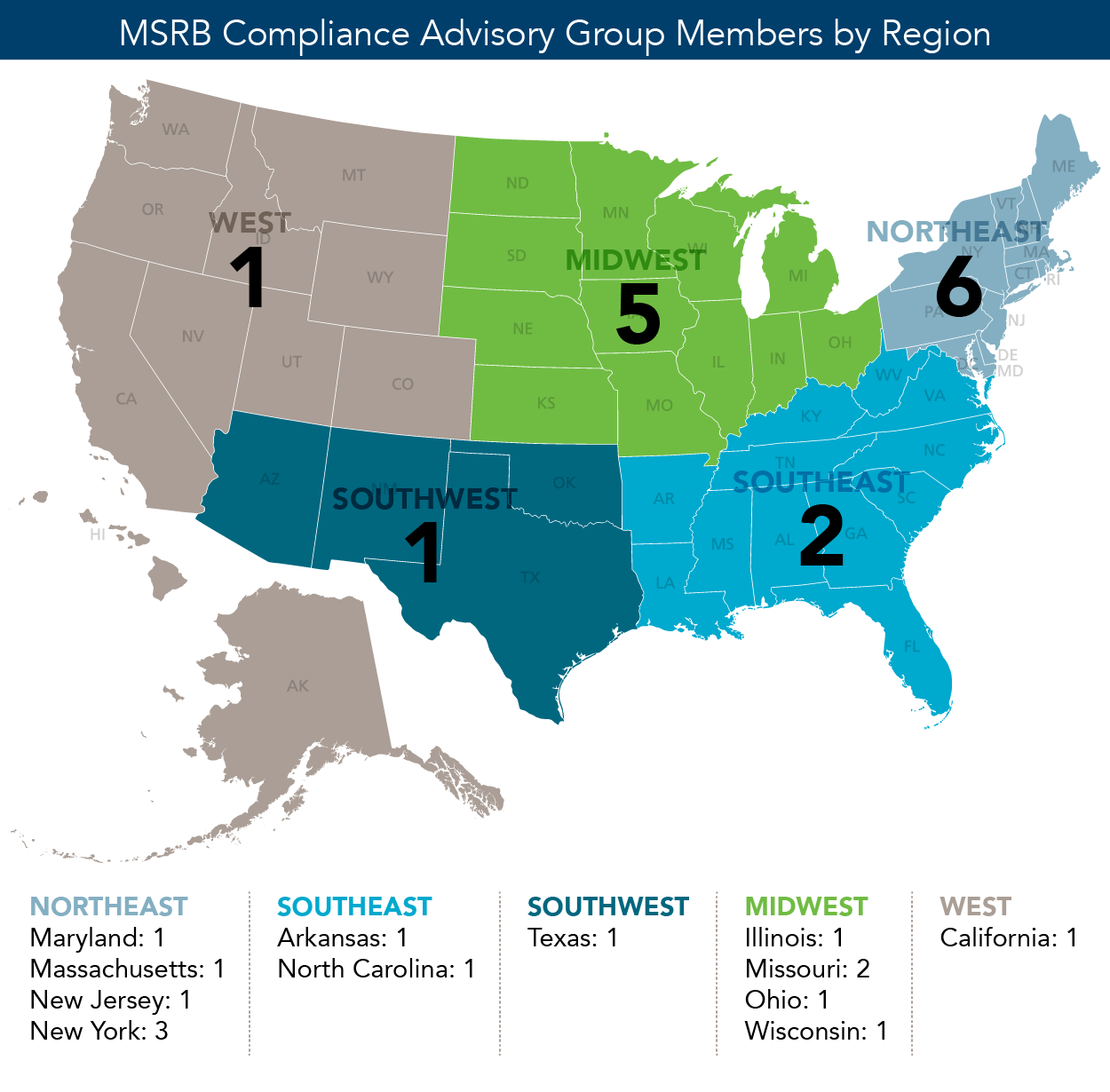

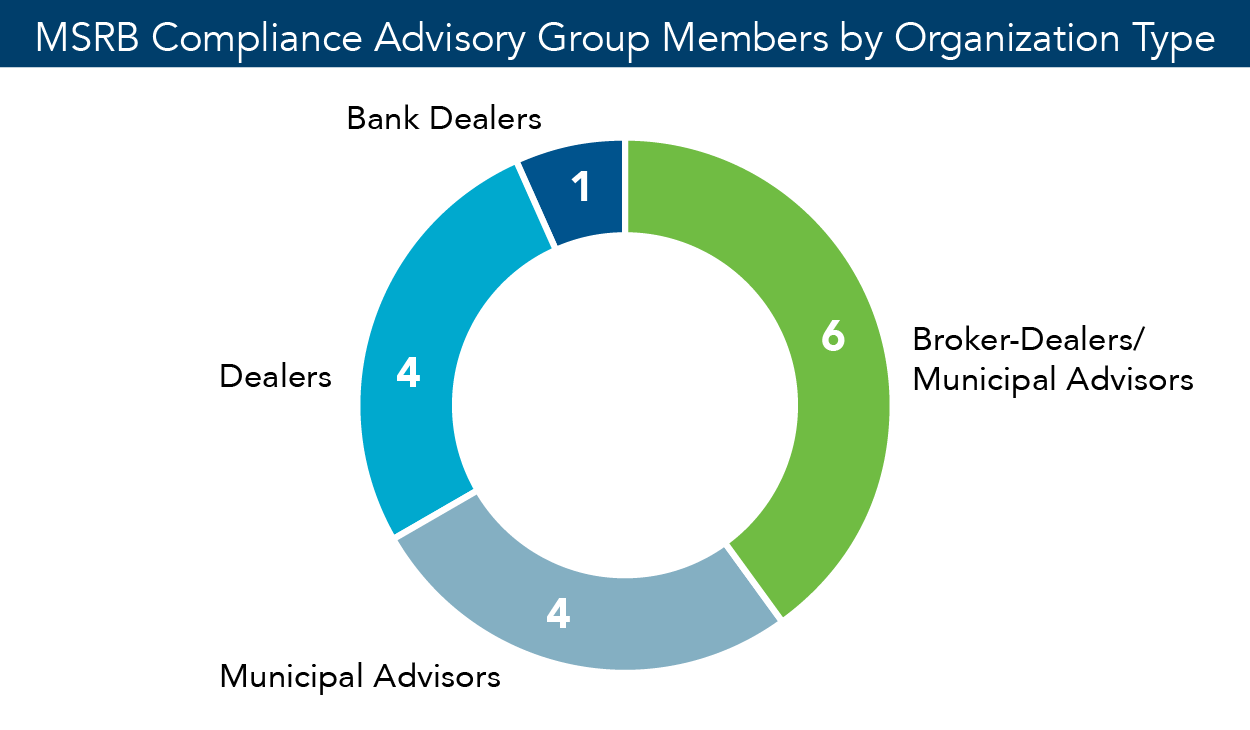

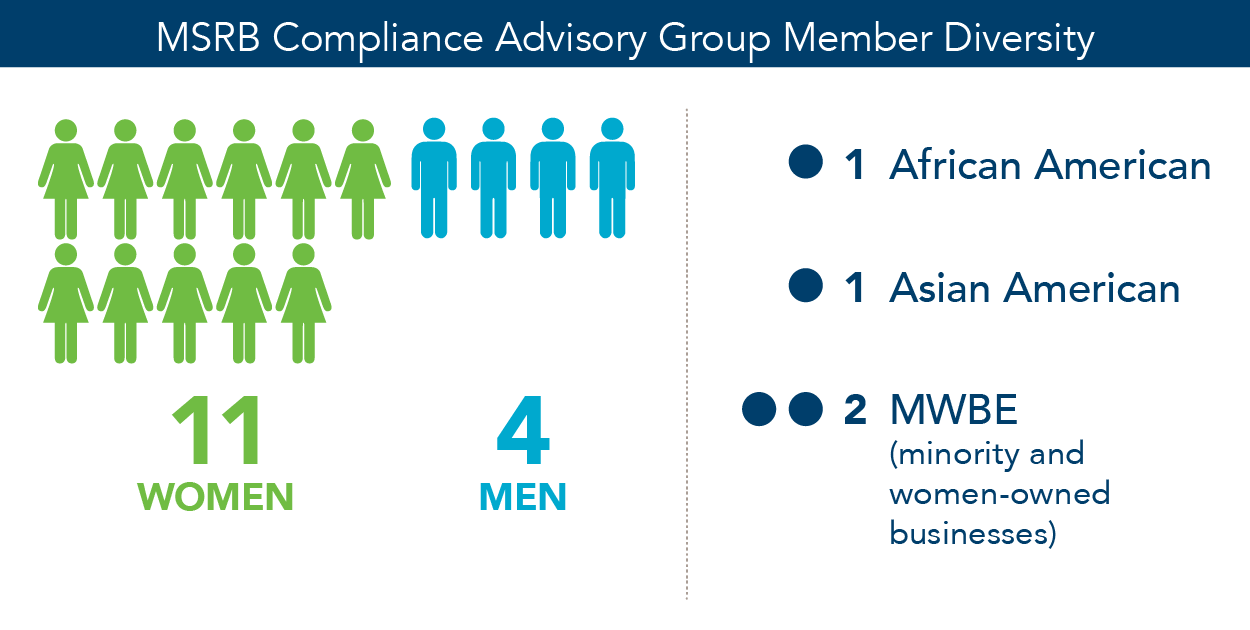

Washington, DC – The Municipal Securities Rulemaking Board (MSRB) today announced the members of its Compliance Advisory Group (CAG). In all, 15 market professionals will be sharing their municipal market and regulatory perspectives with the MSRB.

"The Compliance Advisory Group plays a critical role in providing MSRB staff with valuable insight from market participants knowledgeable about the unique and often complex nature of the municipal securities market,” said MSRB Board Member Donna Simonetti, who will reprise her role as CAG Chair for FY 2023. “We are proud to welcome a diverse group of individuals from across the industry who are willing to share their perspective and offer feedback on compliance resources and tools in furtherance of the MSRB’s goal to enhance understanding of and compliance with MSRB rules.

|

Image

|

Image

|

Image

|

Click images above for larger view

For the sixth consecutive year, CAG will inform the MSRB’s compliance initiatives by providing feedback on areas where compliance clarification and assistance may be warranted and on developed compliance resources and tools.

CAG will continue to be a resource to the MSRB in fostering a dialog and working collaboratively with market participants.

CAG group members for the current fiscal year are:

- Elyse Andrews, Financial Analyst & Chief Compliance Officer, Fiscal Advisors & Marketing, Inc.

- Kimberly Donovan, Compliance Manager / Vice President, H2C Securities Inc.

- Thomas Frain, Deputy Compliance Officer, Siebert Williams Shank & Co., LLC

- Alyssa Glaser, Managing Director, Baker Tilly Municipal Advisors, LLC

- Richard Hartke, Partner, Institutional Sales & Trading, CINCAP Investment Group, LLC

- Heidi Kalisch, Vice President / Compliance Manager, Sr, Hilltop Securities Inc.

- David Leslie, Director, Fixed Income Compliance and Operational Risk Management, Bank of America, NA/MSD

- Mary McPike, Managing Director, Stifel, Nicolaus & Co., Inc.

- Heather Melzer, Vice President / Compliance Program Manager, Public Finance & Municipal Underwriting, Robert W. Baird & Co., Inc.

- Emily Metzler, Senior Vice President/ Chief Compliance Officer, MuniCap, Inc.

- Pamela Mobley, President & CEO, RSI Group, LLC

- Joshua Spurlock, Assistant Vice President, Lead Compliance Officer, Corporate and Investment Banking, Wells Fargo Securities, LLC

- Sydney Teixeira, Compliance Counsel – Capital Markets and Operations Compliance, Edward Jones

- Karen Warren, Principal Operations Officer, Stern Brothers & Co.

- Mary Wong, Director & Head, Transaction Review Group, RBC Capital Markets, LLC

The Municipal Securities Rulemaking Board (MSRB) protects and strengthens the municipal bond market, enabling access to capital, economic growth, and societal progress in tens of thousands of communities across the country. The MSRB fulfills this mission by creating trust in our market through informed regulation of dealers and municipal advisors that protects investors, issuers and the public interest; building technology systems that power our market and provide transparency for issuers, institutions, and the investing public; and serving as the steward of market data that empowers better decisions and fuels innovation for the future. The MSRB is a self-regulatory organization governed by a board of directors that has a majority of public members, in addition to representatives of regulated entities. The MSRB is overseen by the Securities and Exchange Commission and Congress.